Crime and Fraud in Australia Over 2016

With 2016 now well and truly behind us, we can look back and compare how we did, as a nation, in overcoming the ongoing struggle we face against economic crime, fraud and scams.

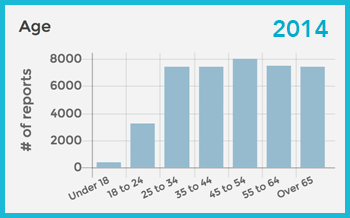

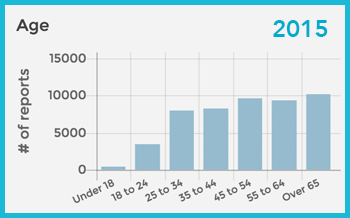

Notoriously, the elderly tend to fall victim more often than those aged below 65, with 10263 reports being made by people aged over 65 in 2015 alone.

In fact, those aged 45 and over account for more than 60% of the 49,475 reports that people made in 2015, where their age was included in the report, and those aged under 24 accounting for less than 8%.

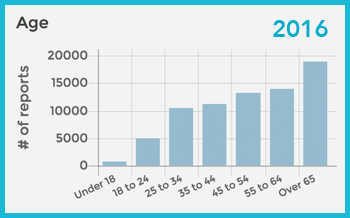

How does that compare to 2016?

Please bear in mind that the final figures for December 2016 have not yet been processed and are therefore not included in this analysis… but with that in mind, aren’t they shocking?

First, let’s take a look at the overviews for each year, and then look at the direct comparison.

2014:

Total Amount Lost: $81,832,192

Total Number of Reports: 91,642

Reports with Financial Loss: 12.1%

Most Expensive Month: November ($11.49 million)

Most Popular Delivery: Phone (48.5%)

Most Dangerous Scam: Investment Scams ($12.46 million)

2015:

Total Amount Lost: $83,770,733

Total Number of Reports: 105,200

Reports with Financial Loss: 9.8%

Most Expensive Month: February ($8.76 million)

Most Popular Delivery: Phone (40.9%)

Most Dangerous Scam: Investment Scams ($24 million)

2016 (until November):

Total Amount Lost: $77,123,877

Total Number of Reports: 144,433

Reports with Financial Loss: 7.2%

Most Expensive Month: October ($9.6 million)

Most Popular Delivery: Phone (40.1%)

Most Dangerous Scam: ($21.22 million)

So, over the last three years, Investment Scams have been the biggest offender and the most damaging act of fraud to hit to Australia. But what is an investment scam, exactly?

There Are Four “Common” Types of Investment Scams

Cold-call Investment Opportunities

Usually, in these types of scams, victims will receive a call from a person claiming to be some form of broker, portfolio manager or account representative of a certain investment firm. They will offer you financial or investment guidance and advice, often leading into some form of attempted sale, claiming that what they’re telling you about is actually an incredibly “low-risk” investment with “rapid and high returns.” Additionally, victims are commonly encouraged to invest in overseas businesses.

The scam artists and their proposal will sound incredibly real and they might be prepared enough to have resources and material to back-up their claims, making it difficult to detect the scam right away. Additionally, they might explain in detail as to why their particular firm needn’t comply with Australian Financial Services Licensing or that they are approved by licensed regulators or that they’re otherwise affiliated with existing organisations or government bodies, again having “proof” to share if requested.

They will, however, be far more persistent than any real broker, often calling back several times, getting more and more pushy and aggressive as time goes on.

The most frequently reported types of investments involved in these scams are usually mortgage, share or high-return real-estate schemes or even foreign currency or options trading. In nearly all cases, however, the person the victim speaks to will not be based in Australia, nor will they be legally permitted to make the offers they claim to be permitted to do.

Be weary and always do proper research before just saying yes. A quick google search and a few questions around social media should give you a really good idea of just how legitimate that call really is.

Furthermore, any real broker will understand if you seem skeptical, and will often provide you with all of the information you need to appropriately determine whether the company is trading in Australia legally.

Superannuation Scams

In these types of schemes, the scam artists usually contact victims via phone and email, informing them of an opportunity to access their Super Funds early. Either the scammers themselves will directly contact their victims, or they may have someone posing as a “financial adviser,” acting on their behalf.

Victims are usually asked to agree to some kind of story that the scammers will need to tell their superannuation provider, thereby tricking them into paying out your super benefits early.

Unfortunately, the truth of the matter is that even if the money is released, the scammers will often take enormous “fees” from the payment, or the whole payment itself, leaving victims with nothing. Additionally, it is the law in Australia that residents (for tax purposes) are prohibiting from accessing the preserved part of their Super Funds until they are aged between 55 and 60, depending on their year of birth and personal circumstances. There are ways to access your Super Fund early, if need be, but this should be done through your provider directly, not over the phone or via email and, as such, if anyone offers you this type of service, they are doing so illegally.

If you’d like more information about how your Super Fund works, please visit the Australia Securities and Investments Commission’s “MoneySmart” website by clicking here.

Share promotions and hot tips

Ever seen the “Wolf of Wall Street” or read the book? Or perhaps you’ve heard of Jordan Belfort? Well, if you have, then you’ll know about how he became a multi-millionaire by misleading customers into buying overpriced or worthless stocks.

While that was some time ago, nothing’s changed and people still fall for it.

In these types of scams, the fraudster will call or email (and sometimes you’ll even find posts on social media and other forums by these guys too) their victims with great news about an amazing offer on “hot” shares that they predict are about to increase in value. Their victims will be presented with a great argument explaining why the shares are on the rise and why now is the best time to buy. Everything you read, hear or see is designed to look like a legitimate inside tip, and victims will be lured into needing to act quickly. The fraudster, however, is simply tying to boost the price of the stock so that they can sell their own shares later on and make a huge profit for themselves. The victims’ shares will then go down in value and therefore result in a huge loss for them and all the other people that got sucked in.

Investment seminars

Investment seminars can be a great way for budding entrepreneurs and investors to learn the ropes and get a foot in the door… however, there are a great many seminars which are, in fact, completely bogus; being run for one reason and one reason alone: to steal your money.

Scammy investment seminars are promoted by investment experts, self-made millionaires and seemingly trustworthy motivational speaks who offer “expert” advice on making high-return investments. The seminars and the people offering the advice are working to convince their victims into following high-risk strategies such as taking out huge loans to buy property, or investments that involve lending money to third parties with little or no securities.

Ok, so they’re not stealing your money from under your nose, per se, but actually the promoters of these seminars make huge amounts of money by charging their audience an attendance fee; by selling expensive reading material; and selling potential investments and properties directly from the seminar without letting victims seek independent advice. The investments being sold at these seminars are usually overvalued and overpriced, or lead to victims having to fork out huge payments to cover hidden fees and commissions that the promoters never mentioned. People going to these seminars will usually experience high pressured sales tactics or misleading claims that could lure them into making dodgy investments, such as guaranteed tenancies or discounted pricing for bring from the seminar that particular day.

Unless you do your due diligence before attending any financial or investment-related seminar, it is likely that any investments you make there or as a result of the advice they share, will result in major losses.

The Australian Securities and Investments Commission actually has a very good article on avoiding these types of seminars and scams too. Click here to have a read.

I highly recommend that you get in touch with Precise Investigation if you feel that you, or someone you know, has been affected by or is on the verge of being scammed.

Our investigators have been helping people across Australia to identify their scammers and have their losses returned wherever possible for close to thirty years… albeit the number of cases, nationally, has increased significantly since then.

Nonetheless, I hope this information has been useful and helped you to understand just how serious scams in Australia are. It is still imperative for regional government and/or any relevant federal organizations to take action in helping the Australian people to minimize the millions we lose every year and stay protected against international scams.

Thanks for reading!