Insurance Investigation Claims and Fraud Services

Activities investigations and factual Investigations are two types of insurance investigation, specifically aimed at assisting insurance companies, banks, self-insurers and associated organisations to effectively determine the legitimacy of a claim.

Australia’s insurance industry loses in excess of $2.2 billion, every year, to false or protracted claims. As a direct result, policy premiums rise to accommodate the loss, which in turn leaves some with no choice other to seek insurance elsewhere, or cancel altogether.

By extension, with Australia boasting some of the highest rates of successful false claims in the world, there comes a greater need than ever for professional insurance investigations and the expert investigators behind them.

Why Employ Us for Activities and Factual Investigations?

Precise Investigation has worked alongside hundreds of insurers across Australia, to provide them with the information they need to effectively determine the nature of the claim and its legitimacy.

Australia’s incredibly turbulent economic crime environment has led to a drastic increase in insurance payouts over the last decade, yet little has been done, on a national scale, to reduce the risks insurers face when dealing with fraudulent or complex claims.

As such, we have developed a series of unique, tailor-made activities and factual investigation services that any insurer can employ to lower the risks in their portfolios.

Both our activities investigation and factual investigation services are aimed at providing insurance companies with a reliable and reputable means of gaining the information they need, whilst treating the claimants with the respect and courtesy they deserve – an all important element of any insurance investigation.

Contact Precise

"*" indicates required fields

Related Services

Speak to an Insurance Investigator Today

Below is a short list of the most common types of insurance-related investigations we undertake, where either an activities investigation or factual investigation may be put to use:

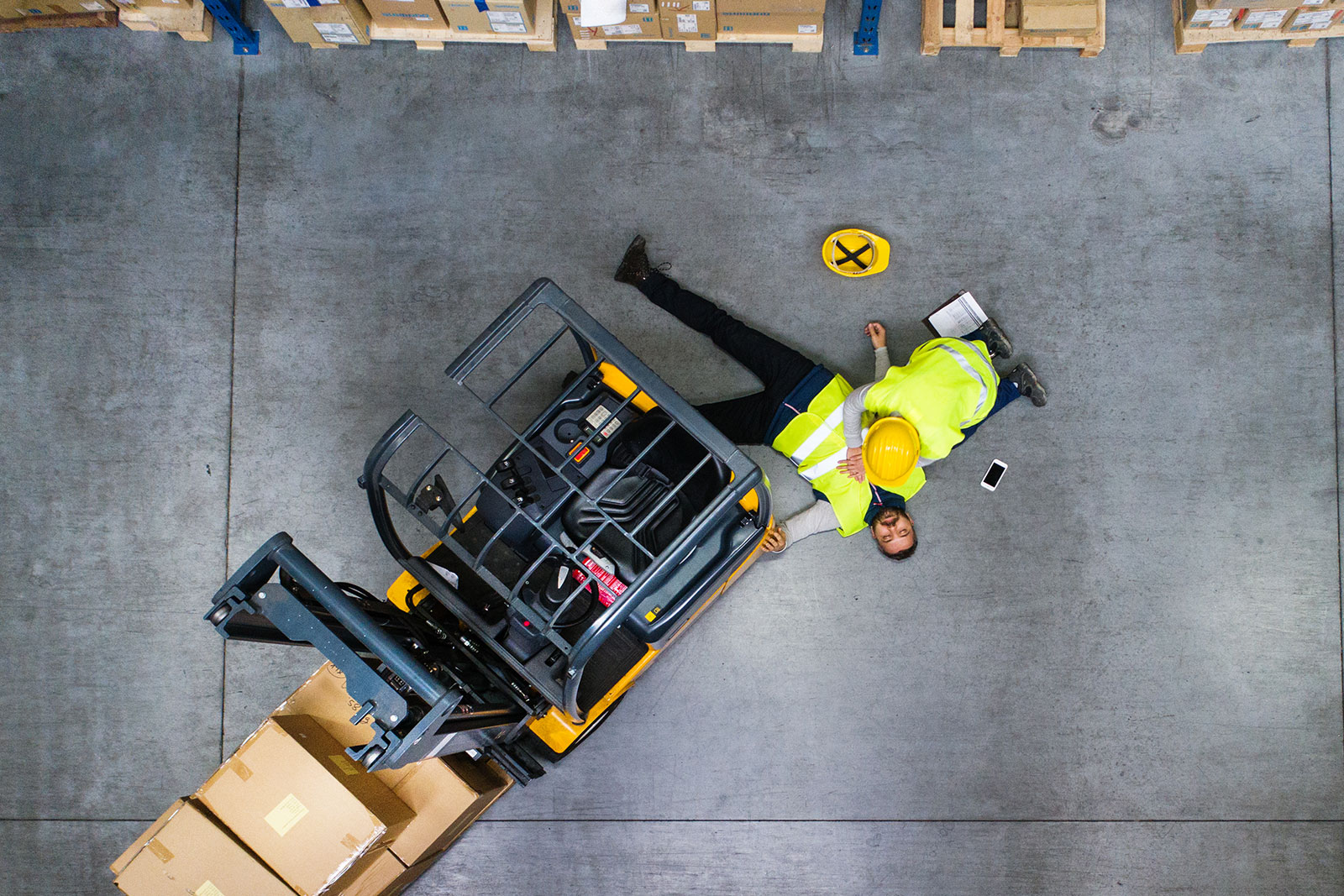

- Workers Compensation

- Personal Injury Claims

- Healthcare Claims

- Vehicular Accident & Motor Incident Claims

- Damaged, Lost or Stolen Goods Claims

- Disability Claims

- Travel Claims

- Public Liability

- Common Law

How to Initiate an Insurance Investigation Services

Precise Investigation will take on a brief, usually in the form of claim notes provided by the insurer, with details of the claimant’s policy, the nature of their claim and the insurer’s point of interest in what that claim involves.

From there, we assign a specialist, depending on which type of investigation is to be carried out;

An Activities Investigation

Typically referred to as “commercial surveillance,” an activities investigation involves monitoring a given Subject or Claimant’s movements from a particular location at a specified point in time. Activities investigations can be used as a means to determine whether a claimant is exaggerating their condition or capacity to return to work; if they’re moon-lighting while claiming to be injured or faking their injury altogether.

A Factual Investigation

A factual investigation typically involves interviewing the claimant and any witnesses, examining and analysing details of the claim and cross-referencing those pieces of information with each other to highlight any discrepancies.

In some instances, a factual investigation and activities investigation may be applied to the same claim, depending on the nature of the claim and those involved.

We boast one of the highest success rates in exposing fraudulent claims of any Australian private investigation firm, and we’re proud to continue offering our services to the many more insurers to help minimize risk within their claims portfolios.

Insurance Investigation

Precise Investigation maintains a regular blog, reflecting on interesting tidbits from the private investigation industry, including topics like crime, love, relationships, statistics and investigation case stories. With that, we have listed a few of our top posts and articles related to background checks for your perusal:

-

Investigator News

How to Deter Insurance Fraud the Right Way

When it comes to insurance fraud, scammers may stage fake accidents or inflate the value…

-

Investigator News

COVID-19 brings out a spike in insurance scammers

The ongoing COVID-19 pandemic and its subsequent restrictions are likely to lead to a rise…

-

Investigator News

Factual insurance investigations: what you need to know

Workers compensation insurance schemes are extremely important to ensure those that are injured or debilitated…